On 30/11, Vietnam Report Joint Stock Company (Vietnam Report) published a study on Vietnam's logistics market in the post-COVID-19 period and announced the Top 10 prestigious logistics companies in 2022.

Accordingly, there are 4 lists classified including: Top 10 prestigious companies in the logistics industry in 2022 - international freight forwarding, warehousing, 3rd and 4th party logistics services; Top 10 prestigious companies in the logistics industry in 2022 - freight industry group; Top 5 Prestigious companies in the logistics industry in 2022 - the group of port exploitation industry and Top 5 Prestigious companies in the logistics industry in 2022 - the group of courier and delivery industry in the last

mile The ranking of Top 10 prestigious companies in the logistics industry in 2022 is built on scientific and objective principles. Companies are evaluated and ranked based on 3 main criteria: financial capacity through the latest year's financial statements; media reputation and survey results of research subjects and stakeholders conducted in October and 11/2022.

According to Vietnam Report, the world is gradually moving into a new state – a new economic cycle. In a period of many fluctuations, the business community faces difficulties piling up from the consequences of the pandemic to the Russia-Ukraine conflict... continue to exacerbate global supply chain disruptions, rising energy and food prices, escalating inflation and sharply rising interest rates...

Against this background, many large enterprises in the world have moved to reposition their supply chains, forming a new globalization trend – post-COVID-19. This is a challenge and also a great opportunity for Vietnamese businesses in general and the logistics industry in particular.

To overcome challenges and seize the opportunity to become an important link in the global supply chain, domestic enterprises must adapt flexibly, constantly innovate with new services and business models, ensure safe logistics to cope with changes in the medium and long term.

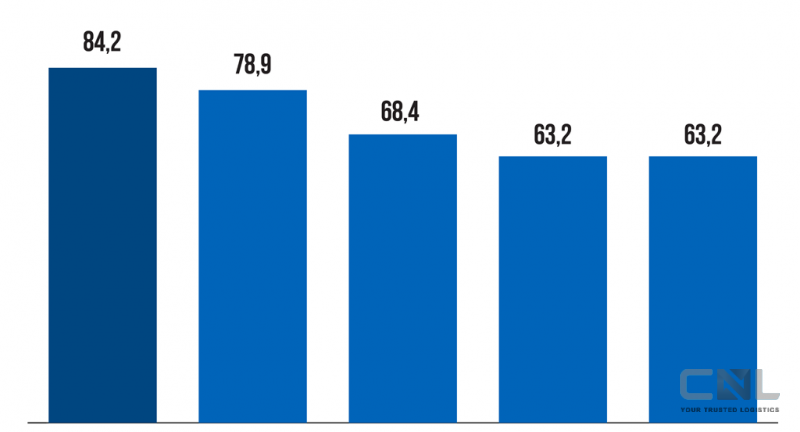

Mr. Vu Dang Vinh, General Director of Vietnam Report, analyzed and recorded that the business results of most businesses in the industry are very positive. Specifically, 68.4% of surveyed enterprises said that revenue in the first 9 months of this year increased compared to the same period in 2021; of which, up to 26.3% recorded a significant increase.

According to the financial statements of 34 logistics enterprises listed on the stock exchange, 64.7% of enterprises still maintain revenue growth momentum compared to before the pandemic (this figure was 35.3% a year ago).

Statistics also show that 26.5% of businesses moved from the group "on the rise" in the period of 2019 - 2021 to "maintain growth momentum" in the period of 2019 - 2022. This shows the continuous efforts of logistics enterprises in the process of recovering and breaking through economic growth after the COVID-19 epidemic.

Along with that, Vietnam Report's survey also showed that the biggest difficulties that logistics enterprises are facing are fluctuations in energy prices and input materials; competition between enterprises in the same industry; risks from the supply chain; political instability in the world and reduced demand for shopping and consumption.

The biggest challenge is energy price fluctuations – the biggest difference in the logistics economic picture this year, stemming from the Russia-Ukraine conflict that brought a major shock to supply that caused the global energy market to fluctuate sharply. Fuel costs account for a large proportion of the operating cost structure, posing a big problem for logistics enterprises in terms of price adjustment.

In particular, 63.2% of enterprises surveyed by Vietnam Report said that total costs increased in the first 9 months of this year compared to the same period last year. Nearly 1/3 of enterprises recorded a significant increase in gasoline costs. When fuel prices become a burden for businesses, it will cause many disadvantages in competition, such as increasing the difference in logistics costs of Vietnam compared to the world average and in the region.

In the ASEAN region, Vietnam was at 16.8%, higher than Singapore at 8.5%, Malaysia at 13.0% and Thailand at 15.5%.

In addition, risks from supply chain disruptions, political instability in the world, reduced shopping and consumption demand due to rising inflation in developed countries also create a significant resonant impact on domestic logistics activities.

Many experts said that Russia-Ukraine tensions are disturbing global supply chains that are already very "fragile" after the impacts of the COVID-19 pandemic. However, in the face of complicated developments in the world, nearly 80% of businesses forecast that this challenge will continue until the end of 2023, even longer when covid-19 prevention and control measures are removed in most markets.

In addition, 52.6% of businesses surveyed by Vietnam Report said that the number of orders decreased, inventory increased. Notably, in some enterprises, the decrease is up to 30-40% over the same period in 2021.

Facing the problem, Mr. Vinh recommended that in the coming years, businesses need to innovate their thinking and take people as the center; at the same time, promoting digital thinking, establishing positive cultural norms, standardizing processes, and continuously training the workforce.

Ngọc Quỳnh/BNEWS/TTXVN