TTO - Lack of professionalism, low automation, productivity of service implementation has not reached advanced countries, the application of information technology and the level of digitalization is not high, leading to reduced competitiveness compared to the international market.

Vietnamese logistics enterprises seek to increase competitiveness, reduce costs to participate deeply in the global value chain - Photo: QUANG DINH

That is the comment of Mr. Le Duy Hiep - Chairman of Vietnam Logistics Service Business Association (VLA) - at the forum "Logistics Vietnam - Transforming development" organized by the Business Forum magazine in collaboration with VLA and SEA Logistic Partners (SLP Vietnam) on 19-10.

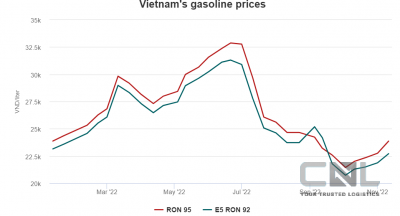

According to Mr. Hiep, the industrial revolution 4.0 has given rise to many special arising services. The logistics service provider market of Vietnam and the world competes fiercely when e-commerce develops dramatically with advanced forms of logistics services such as E-logistics, Green logistics ... making the service costs of Vietnamese logistics enterprises still relatively high.

Commercial Director of SLP Vietnam Company Le Thi Ngoc Diep said that the current bottleneck in infrastructure from airports, seaports, warehouses ... unregulated, dispersed. In particular, the planned warehousing system has a difference between the North and the South, leading to restrictions in the transportation of goods across the country.

Products and services that promote transportation flexibility in logistics to optimize efficiency, costs are displayed, introduced to businesses to visit and learn - Photo: CONG TRUNG

According to VLA statistics, Vietnam's logistics market has more than 5,000 enterprises, of which 89% are small and medium-sized Vietnamese enterprises, 10% are joint venture enterprises and 1% are 100% foreign-owned enterprises providing transnational logistics services. Logistics-related costs account for about 20% of GDP in Vietnam, but in advanced countries, this figure is only about 7-9%.

The boom in e-commerce in Vietnam with large enterprises such as Shopee, Lazada or Tiki becomes a potential opportunity for corporations to invest and develop modern logistics infrastructure. This is an opportunity for businesses to participate deeply in supply chain development, step by step digital transformation to participate in the global value chain.

Mr. Le Trong Hieu - Senior Director of CBRE Vietnam - said that in order to catch the "wave" of logistics, it is necessary to pay attention to developing the use of warehouses effectively, increasing the speed of order processing, reducing costs. Becauseretail and e-commerce both want their warehouses to be closer to customers, because as soon as customers click to buy on the application, in a very short period of time, they must process orders at the fastest possible speed.

If the remote warehouse location will take a long time to pass through the crowded downtown area, the operating costs will increase. Therefore, building warehouses helps optimize the delivery of goods to customers. "Thepenetration of e-commerce in Vietnam is still quite low, but by 2024-2025, this number will increase from 15-20%, even 50%" - Mr. Hieu forecast.

According to businesses, Vietnam currently possesses all the advantages to promote logistics development, including a country with a young population, about 100 million people; stable government support policies, extensive trade agreements with other countries.

Mr. Phan Van Chinh - Director General of the Import and Export Department - Ministry of Industry and Trade - said that there should be support and links between logistics enterprises to jointly promote and develop the market. Build "leading" businesses with sufficient capacity and scale to advise and lead businesses in the industry in a symbiotic model, growing and developing together.

CONG TRUNG-tuoitre.vn